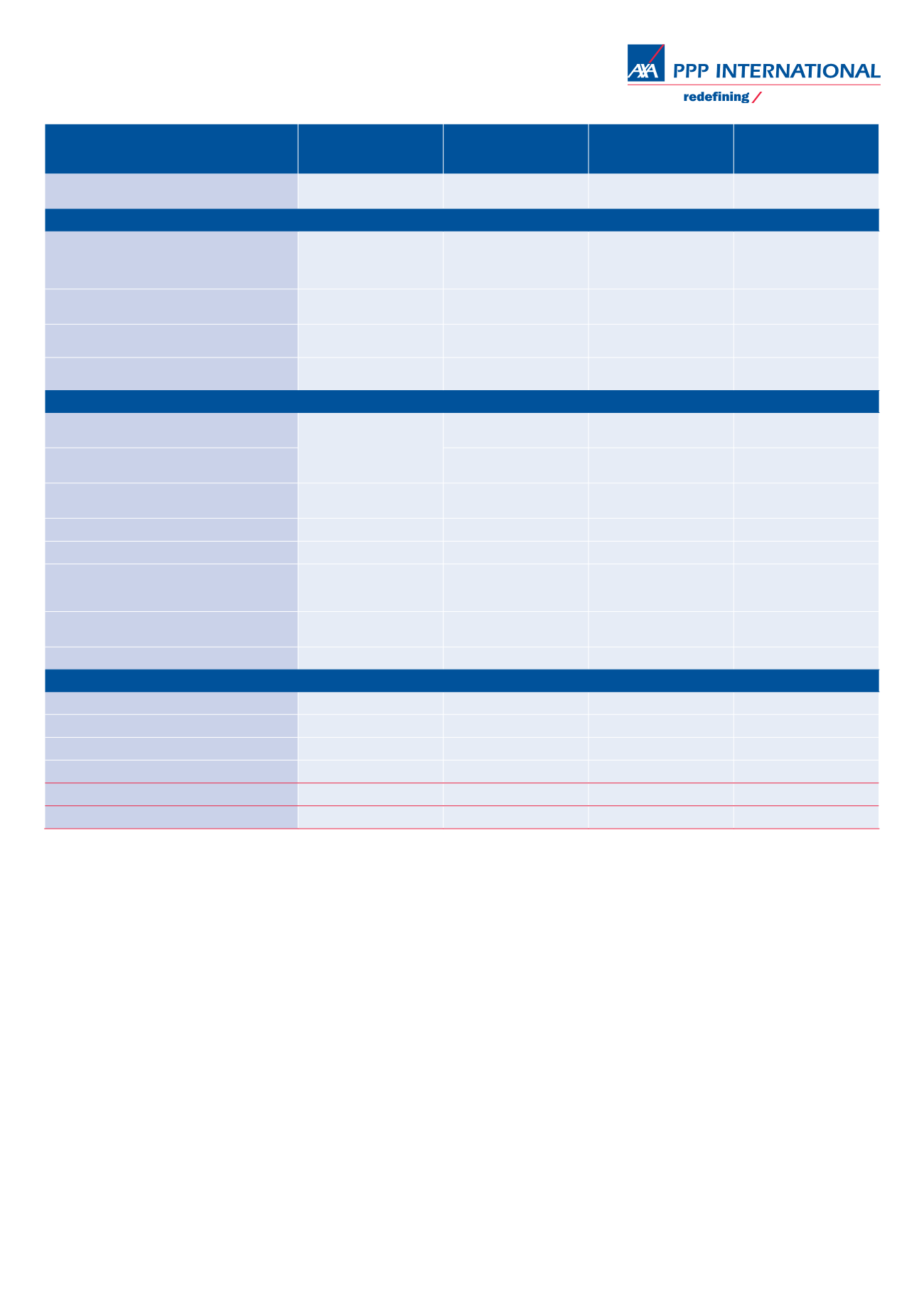

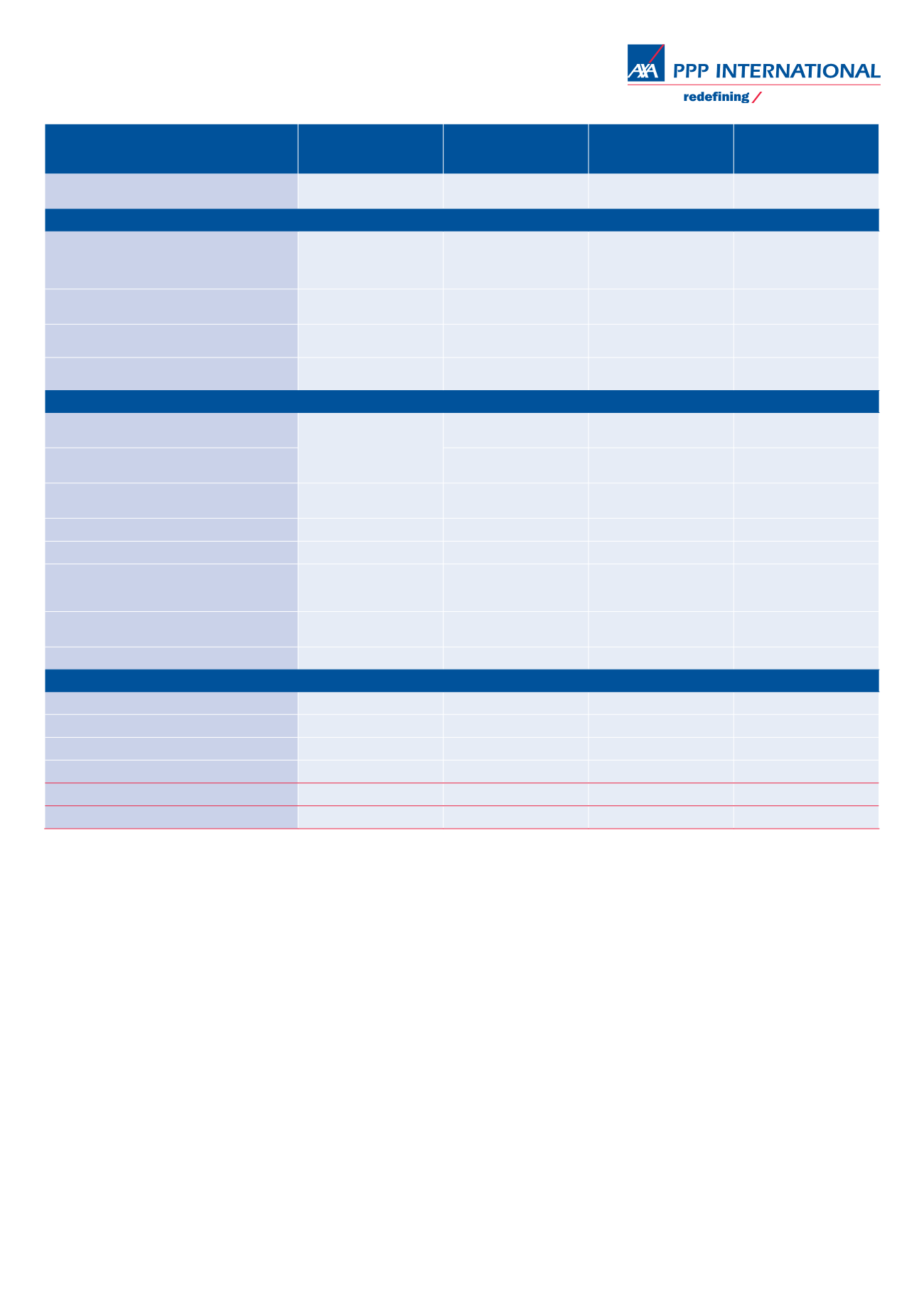

The four levels of cover you can

choose from

Prestige Plus

Prestige

Comprehensive

Standard

Palliative care

Up to 30 days

Up to 30 days

(Cancer diagnosis only)

Not included

Not included

Emergency treatment

Emergency treatment in the USA. Emergency in-

patient and day-patient treatment which arises

suddenly whilst you are in the USA. Applicable only

for plans with worldwide excluding USA area of cover

Up to 10 weeks up to a limit of

£30,000/

€

38,250/$48,000

Up to 10 weeks up to a limit of

£20,000/

€

25,500/$32,000

Up to 6 weeks up to a limit of

£15,000/

€

19,125/$24,000

Up to 6 weeks up to a limit of

£10,000/

€

12,750/$16,000

Emergency out-patient treatment whilst you are in

the USA (not applicable with USA upgrade)

Up to

£2,000/

€

2,550/$3,200

Not included

Not included

Not included

Ambulance transport for emergency transport to or

between hospitals

Up to £700/

€

890/$1,120 Up to £500/

€

635/$800

Up to £500/

€

635/$800

Up to £500/

€

635/$800

Evacuation and repatriation service (International

emergency in-patient treatment)

Included

Included

Included

Included

Health and wellbeing cover

Non-routine dental care. For example, replacing

crowns

80% of costs incurred up to

£3,500/

€

4,450/$5,600

50% of costs incurred up to

£500/

€

635/$800

50% of costs incurred up to

£320/

€

405/$510

50% of costs incurred up to

£320/

€

405/$510

Routine dental care. For example, check ups, scale

and polish

Not included – optional

add-on available

Not included – optional

add-on available

Not included

Accidental damage to teeth

Up to

£10,000/

€

12,750/$16,000

Up to

£10,000/

€

12,750/$16,000

Up to

£10,000/

€

12,750/$16,000

Up to

£10,000/

€

12,750/$16,000

Optical cover

Up to £200/

€

255/$320

Up to £100/

€

125/$160

Up to £100/

€

125/$160

Not included

Eyesight test cover

Paid in full for one eyesight test Paid in full for one eyesight test Paid in full for one eyesight test

Not included

Health check

Up to £400/

€

510/$640

towards a health check for

each member on the policy

Up to £300/

€

380/$480 each

year towards a health check

for each member on the policy

Not included

Not included

Disability compensation cover

Up to £100,000/

€

127,500/

$160,000

Up to

£50,000/

€

63,750/$80,000

Not included

Not included

External prosthesis

Up to £3,500/

€

4,450/$5,600 Up to £2,500/

€

3,200/$4,000 Up to £2,000/

€

2,550/$3,200 Up to £1,500/

€

1,900/$2,400

Support and helplines

Health at Hand

Included

Included

Included

Included

Security Hotline

Included

Included

Included

Included

Doctor, Dental, Optical helpline

Included

Included

Included

Included

Interpretation service helpline

Included

Included

Included

Included

Personal Medical Case Management

Included

Included

Included

Included

International Travel Plan

Included

Included

Optional

Optional

healthcare

Summary of Benefits

Excess

You can help control the cost of your premium by adding

an excess to your policy. We offer five levels of excess,

per person, per year.

Excess amounts:

£100

€

125 $160

£250

€

320 $400

£500

€

640 $800

£1,000

€

1,275 $1,600

£2,000

€

2,550 $3,200

Exclusions: What’s not

included in the health plans

Our International Health Plans are designed to cover treatment of

medical conditions that respond quickly to treatment – known as acute

conditions. Like most health insurance policies, there are a number of

exclusions and limitations on the plans and this is just a summary of the

most significant exclusions and limitations:

– Pre-existing medical conditions; options to include these are available

for company schemes of five or more

– Routine dentist check-ups for Standard, Comprehensive or Prestige

plans (available as an add-on to Comprehensive and Prestige plans)

– Routine pregnancy and childbirth on Standard or Comprehensive

plans (available as an add-on to Comprehensive plans for corporate

schemes only)

– Preventative treatment

– Ongoing, recurrent or long-term treatment of long-term illnesses

(usually referred to as Chronic conditions) if you have the Standard

plan

– Any treatment costs incurred as a result of engaging in or training for

any sport for which you receive a salary or monetary reimbursement,

including grants or sponsorship (unless you receive travel costs only).

Full details of what members are and are not covered for are provided

in the membership handbook, or are available on request.